THE MONETIZATION PLATFORM

Everything you need to win in the subscription economy.

INTEGRATIONS

Join the world’s leading brands who monetize with CloudBlue. Explore our flexible pricing plans.

Error processing the submission, please try again.

Everything you need to win in the subscription economy.

Everything you need to win in the subscription economy.

CloudBlue is a Representative Vendor in the 2023 Gartner Market Guide for Marketplace Operation Applications

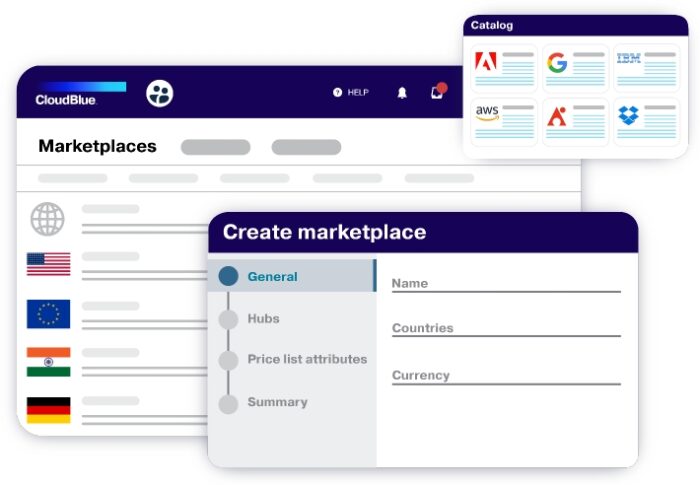

Procure, purchase, and sell products globally in various currencies and languages.

Increase ARPU and customer retention. Expand your B2B catalog of cloud solutions and sell them at scale.

Manage your cloud reselling business at a truly global scale without having to worry about growing operational costs.

Drive ARR and reduce operational costs. Manage all SaaS procurement and fulfillment on one platform.

Subscriptionize your products and create value-added solutions to sell directly to your customer or though your channel.

Darek Tasak is leading Customer Success & Value Creation for CloudBlue. In his role, he looks after CloudBlue customers globally during the entire lifecycle of our relationship: from the initial on-boarding, through in-life account management, always ensuring they build successful businesses leveraging our technology. Additionally, he is also in charge of Partnership & Alliances, as well as Pricing Management for everything we commercialize.

Before CloudBlue, Darek managed Ingram Micro’s Services division for hi-tech customers in Europe & APAC. His prior experiences include also launching and leading pan-European services business for TDSynnex, as well as strategy consulting with Boston Consulting Group (BCG).

As President of CloudBlue, Uddhav is a distinguished leader and visionary with nearly two decades of platform-building experience. He is an industry leader in digital commerce, the subscription economy, and monetization platforms.

Notably, at SAP, he spearheaded the transformation of their platform business into a multi-cloud platform-as-a-service, offering enterprise and developer-friendly subscription models. At Pure Storage, he championed the efforts to successfully disrupt the storage industry by creating revolutionary Storage-as-a-service, AIOps-as-a-service, and Disaster Recovery-as-a-service offerings with cutting-edge features and establishing a sophisticated subscription commerce infrastructure that is channel-friendly.

At CloudBlue, Uddhav guides and empowers businesses to rethink their monetization strategies by unlocking the power of digital ecosystems and marketplaces. CloudBlue provides enterprises with a mature multi-tier, multi-channel marketplace and monetization platform that enables usage-based subscription models and global delivery of Anything-as-a-Service solutions. Uddhav has played a pivotal role in shaping the future of the subscription economy through his innovative thinking and impactful contributions.

THE MONETIZATION PLATFORM

INTEGRATIONS

SERVICES

BY OBJECTIVE

BY INDUSTRY

BY USE CASE

PARTNER TYPES

PARTNER MODELS

JOIN OUR NETWORK

RESOURCE CENTER

ESSENTIAL REFERENCES